What is a stock market? What is stock trading and how to start investing in the stock market?

(learn the stock basics step by step)

If you always wanted to be an entrepreneur, achieve financial freedom, and have free time to do whatever and whenever you would like to do - trading and investing are some of the best skills to learn.

Learning how to trade and invest are the only skills that guarantee you income for the rest of your life. Because these days, if you learn a skill like mechanics, programming or engineering, you can be replaced in the future by someone who can do it cheaper, someone who is younger, faster…

When you have the knowledge to trade and invest in financial markets, from anywhere in the world, as long as you have a laptop and internet, you have a business for yourself. You have the ability to create income for the rest of your life. And that is the true freedom and security.

Stock trading and investing are very flexible businesses. Besides the fact that you can work from anywhere in the world, you can also work whenever and as long as you want. You have no employees, no rentals like in other businesses, and the business is recession-proof.

Read this article and learn different things about Stock Market, Trading and Investing such as:

- What is a stock market

- How does the company become listed on the stock market

- What is a share of the company

- How to make money in stock market

- Bonus: Stock Market e-book

What is a stock market?

A stock market is a place where people buy and sell shares of public listed companies. Each time you buy shares, you are buying the right to the ownership of the company. So you are actually buying and selling companies through shares.

How does the company become publicly listed on the market?

Let’s say you are the owner of a restaurant. You start generating serious money and you decide to open a few more in the next few years, with the same name. Few years after you have your restaurant chain and you prove that you can manage your business well. You can generate cash flow, pay debts in time, pay the workers... So you list your company on the market so that other people can invest in your business too. Then you split your company into 100% of shares. You keep some shares for yourself and other people can buy shares and own part of your company. You start opening more restaurants, generating more sales, and the share price of your company is rising – which means that other people who own part of your business are making money with you.

The same goes for big companies like McDonald’s, Facebook (now Meta), Coca-Cola, Instagram, and Tesla… You buy and sell shares of those companies to make a profit. Some of the richest men in the world, like Warren Buffet, made their fortune this way – by investing in companies, and buying parts of great businesses without ever doing any work.

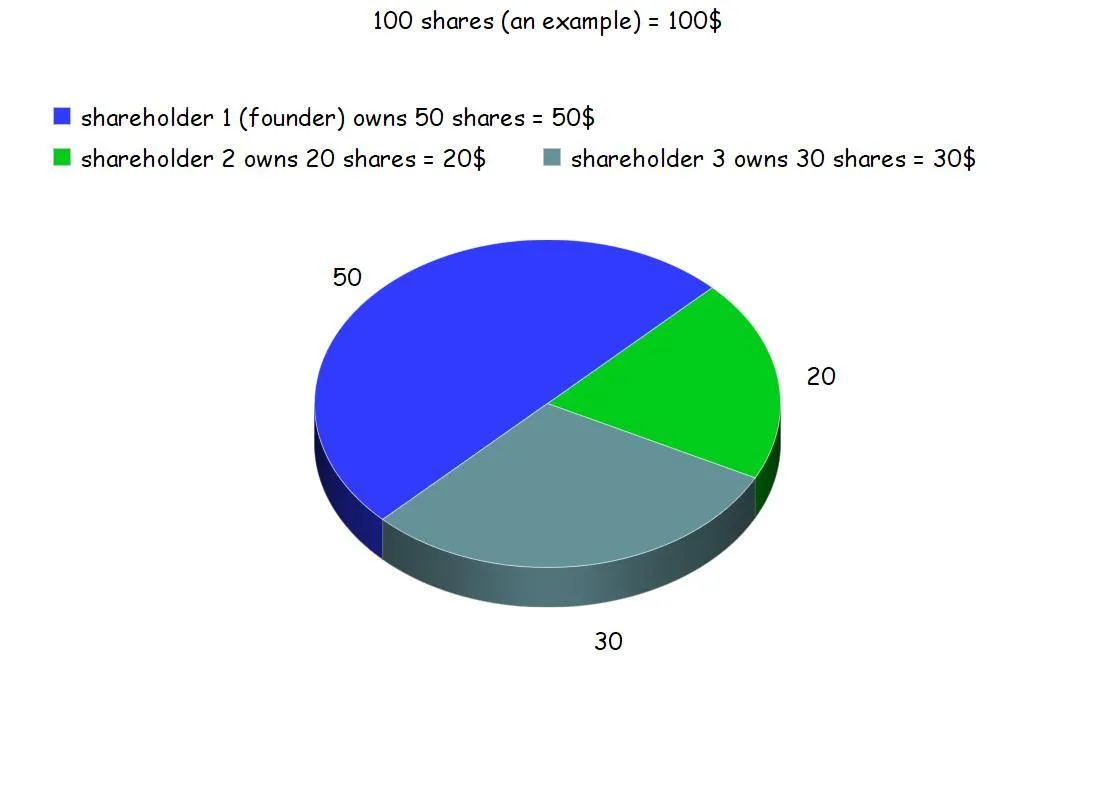

What is a share of the company?

A share of stock represents ownership of a company and its profit. For example, Twitter has 795.35 million shares outstanding. The price for one share is 56.78$ and it changes every moment. That means that Twitter's market capitalization (total value) is 45.16 billion (shares number multiplied by shares price).

People buy shares of the company because they think the price is going to go up. They are called BULLISH in the world of trading, or BULLS. Other people sell shares because they think the price is going to go down. They are called BEARISH in the world of trading, or BEARS.

Have you ever thought about what might happen if you want to sell, but there’s no buyer? That is the reason why we mostly focus on the US stock market, the biggest stock market in the world. The US market has the widest range of companies and the biggest number of shares being sold, or what we call it in the investing world- the highest liquidity. In the time of writing this book, more than 7800 companies are listed on the US stock market that you can buy and sell for profits every single day. They have big liquidity and you never need to worry if someone is going to buy shares of your stock.

How can you make money in stock markets?

There are 3 ways to make money in the markets. You can:

1. Go long - buy stocks with the anticipation of the price moving up.

2. Go short - selling stocks with the anticipation of the price moving down.

3. Dividends (for investing) - distribution of profits by a corporation to its shareholders.

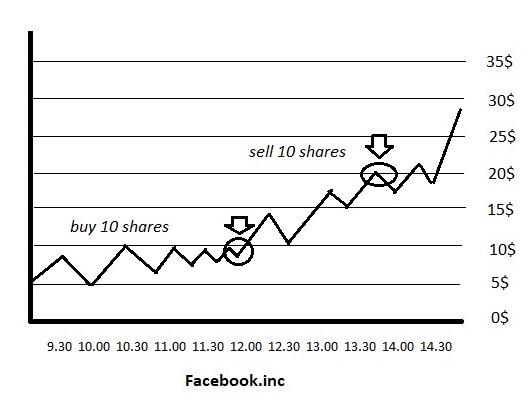

Let’s say you buy a stock (for example Facebook) when the price is at 10$ per share. It means you opened your position. And you sell it later at 20$ per share to close a position. You made profits. You bought one share of stock at 10$ and sold it at 20$. The difference is 20-10=10$. You just made 10$. In case you bought one share, that would be your profit.

For example: If you bought 10 shares of a company (let’s say Facebook) at 10 dollars, and you sell them one day later when the price is 20 dollars, you will spend: 10 shares x 10 dollars = 100 dollars to buy. The price when you sell is 10 shares x 20 dollars (now the share price went up) = 200 dollars. So you made 200-100=100 dollars.

An example of buying shares

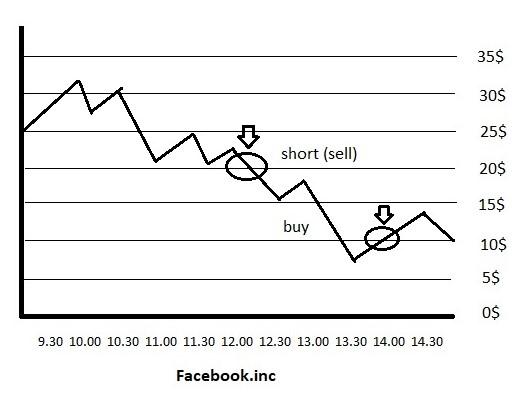

Most people think that buying shares is the only way to make money with stocks, and that is not true. The beauty of trading and one of the differences from investing is that in trading you can also make money when the price goes down.

The second way to make money is by shorting (short selling) a stock at a higher price and buying it back at a lower price. Let’s say you short it (sell) at 20$ to open a position because you believe that the price is going to go down, and you buy it back at 10 to close a position. So with the same math, you made 10$ in case you shorted just one share, or 100$ if you shorted 10 shares.

An example of shorting (short selling) shares

Now, you may wonder how you can sell (short) a stock that you don’t own. Well, It means that when you click sell (short sell), the broker is lending you shares that you need to bring back. So basically you borrow shares from your broker at 20$ and then you need to return it back. But your goal is to buy it back for a cheaper price so that you can make a profit. When you sell, it is called: selling short, and when you buy back it is called buying or covering the position.

You may also question why a broker would lend you shares. One of the reasons is that it gives liquidity to the market. Another reason is that they charge the fees for landing you. It is a pretty low price for borrowing, but since they have millions of people borrowing, brokers make very good money out of it. The longer you borrow, the bigger is the interest rate. So It’s in our interest to make a profit and close a position.

Another difference between trading and investing is, that for trading, there is no good market or bad market if you are a professional. You can profit both ways when you follow the direction of a stock price. And you are the one who could determine the directions of stock prices by studying patterns and trends. You go long when the markets go up and you go short when the markets go down and that is how you make money. In investing, you go long when markets go up, but you can get out of your investment once the markets start going down and buy it back again when the markets are recovering...

That is not all.

There is a lot more about Stock Market, Stock Trading and Stock Investing for beginners such as:

how to protect yourself;

how to recognize trend;

how to manage your positions;

how to find a good broker;

...but it would be too much for just one blog post.

That's why we wrote a free e-book to help you to learn more about the stock market, stock trading, and stock investing.