NOYA AI (NOYA) ICO Review 2026: One of the Best Crypto Presales for “Agentic AI” + Prediction Markets?

If you’re searching for best crypto presales, crypto presales, presales crypto, ICO, or even the best crypto ICO 2026, here’s what separates winners from hype:

Real product + fair launch + real value accrual. That’s exactly what NOYA AI is positioning itself as: “Intelligence That Acts” — an always-on institutional research desk that turns raw on-chain noise into structured edge… and then executes instantly across 10 chains.

And the part that’s turning heads?

NOYA’s sale structure is built around a low initial circulating market cap (~$1,000,000 at TGE) and a fair launch model designed to avoid the #1 presale killer: cheap insider allocations dumping at launch.

Noya AI Presale Quick Summary

Project: NOYA AI (NOYA)

Category: Agentic AI + Prediction Markets + Omnichain Execution + DeFi vaults

Public sale: via Gems

FDV: $10,000,000

Vesting: 20% unlocked at TGE, then linear over 6 months

Core token engine: protocol revenue → buyback & burn

Fair launch claim: No VCs / no KOL rounds

Where to buy? https://gems.vip/noya-ai

Private sale code: 5107428111

Why NOYA Is a Strong “Best Crypto Presales 2026” Candidate

1) The Market Tailwind: Prediction Markets Are Exploding

Prediction markets went from “niche” to a mainstream battleground fast. Multiple reports describe massive growth in volume through 2024–2025, with Polymarket and Kalshi becoming major players.

That matters because prediction markets create a new kind of trading environment:

- fast-moving information

- shifting probabilities

- crowdsourced signals

- constant alpha decay

NOYA’s pitch is simple: If you can interpret these signals better than the crowd — and execute faster — you win.

2) “Agentic AI” Is Overpriced… NOYA Claims the Opposite

Many “agentic AI” tokens launch at huge valuations, often with:

- VC overhang

- big unlock cliffs

- weak product utility

NOYA’s docs explicitly frame this as a valuation disconnect, claiming it launches at a fraction of typical sector valuations and highlights a low circulating market cap at TGE.

3) It’s Not Just Research — It Executes (This Is the Difference)

Most tools stop at dashboards.

NOYA is designed to:

- analyze

- form a “winning view” (fundamentals, risks, market context)

- and then execute instantly across chains (omnichain).

That “research → action” loop is what makes it feel like an institutional desk, not a retail analytics app.

Live Protocol Metrics (What’s Already Built)

NOYA highlight traction signals such as:

- Live on 10 chains

- 30,000+ active researchers

- 2,000+ prediction markets analyzed

- Tracking 400+ tokens & institutional reports

- Mentions of recognition like Top 5 on Kaito leaderboard and event wins

These metrics matter because the best crypto presales typically have product reality before the token hype.

What NOYA Actually Does (Product Breakdown)

A) Prediction Market Copilot (Polymarket-style Edge)

NOYA is positioning itself as an AI intelligence layer built specifically for prediction markets:

- EV framing (expected value vs implied probability)

- wallet tracking (high win-rate participants / “smart money” behavior)

- news correlation (probability shifts tied to events)

- performance analytics (PnL, win rate, portfolio insights)

In plain English: it tries to turn “gambling vibes” into disciplined trading decisions.

B) Omnichain AI Agent (Your On-Chain Research Partner)

The agent layer is designed for questions like:

- “Analyze token risks”

- “Find mispriced prediction markets”

- “Check holder distribution / liquidity depth”

…and then the platform aims to help you execute across chains where relevant.

C) Omnivaults (Modular Yield + Strategy Layer)

NOYA describes vaults as modular positions (receipt tokens) that can be composable with DeFi — designed for structured strategies rather than random yield chasing.

D) Token Intelligence (Fund-Grade Research, Automated)

A big part of NOYA is automated “institutional-style” scoring:

- fundamentals over hype

- catalyst/unlock tracking

- risk flags for dilution & centralization

How to Buy Noya AI ($NOYA token) – Private Sale Access: Step-by-Step

- Visit the official site: https://gems.vip/noya-ai and click BUY NOW

- (Always verify you’re on the correct website — avoid phishing clones.)

- Enter the Referral Code: 5107428111

- Read and accept the token sale agreement, then enter your email address

- Connect your wallet (e.g. MetaMask or Trust Wallet)

- Purchase NOYA for your desired amount

*Make sure you have enough ETH to cover gas fees (~$10–15)

You’ll be able to claim your tokens before the official exchange listing.

The Fair Launch Angle (Why This Matters for Presales Crypto)

NOYA’s docs explicitly state a “fair launch guarantee,” including:

- No VCs (no private rounds with huge discounts)

- No KOL rounds

- avoiding predatory market maker structures

- avoiding token-paid CEX listing “backroom deals”

Whether you’re new or experienced, this matters because presales often fail due to structure, not tech.

NOYA AI Tokenomics: Real Value Accrual (Buyback & Burn)

NOYA’s docs describe a model where protocol revenue from:

- agent transactions

- vault fees

- premium intelligence tools

is used to buy back NOYA and burn it (reducing supply permanently).

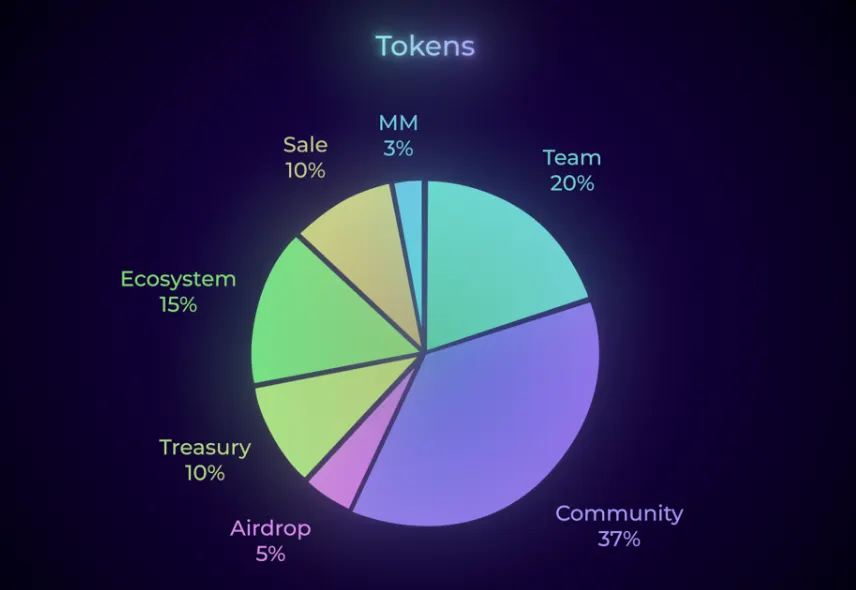

Distribution (high-level)

From NOYA’s tokenomics page:

- 37% Community emissions (linear over 60 months)

- 20% Team (0% at TGE, 6-month cliff, then vesting)

- 15% Ecosystem & partnerships

- 10% Foundation / treasury

- 5% Airdrop (majority liquid at TGE; some vesting for stability)

This structure is designed to reduce “instant dump” dynamics.

Noya Sale Details (What You Need to Know)

From NOYA’s official sale overview:

- FDV: $10,000,000

- Soft cap: $750,000 / Hard cap: $1,500,000

- Vesting: 20% unlocked at TGE, then linear over 6 months

Sale window: January 26 - Until SOLD

Why Many Investors Prefer Gems Launchpad for Crypto Presales in 2026

If you’re researching ICO platforms and presales crypto, you’ll keep seeing Gems mentioned as a launchpad focused on early access to pre-listed tokens.

Also, recent public coverage notes Gems leaning into incentive-driven launch structures — positioning GEMS as officially #1 in ROI for token performance on the CryptoRank Index 2025!

Their best performance crypto ATH from presale:

$GEMS 5× | $RAIN 22× | $ASTRA 13× | $LUCK 9× |

(Important: past performance doesn’t guarantee future returns — but it explains why the platform gets attention.)

Risks to Consider

- Token launches can be extremely volatile (especially around TGE)

- Adoption must keep scaling for revenue mechanics to matter

- Prediction markets and related tooling can face regulatory and platform changes

Final Verdict: Is NOYA Worth Buying Crypto ICOs of 2026?

If you want a presale that’s not just “AI buzzwords,” NOYA is compelling because it combines:

institutional-grade research + prediction market edge + omnichain execution,

and backs the token with a real value-accrual engine (buyback & burn).

If you’re researching best crypto presales, crypto presales, ICO, presales crypto, or best crypto ICO 2026, this is one to evaluate before the broader market catches on.

Learn More About the Project:

🔗 Also, Make Sure To Check Other Active Crypto Presale Projects For 2026:

If you decide to join the presale, don’t forget to use the referral code: 5107428111

⚠️ Disclaimer:

The content published on our website is for educational and informational purposes only and does not constitute financial advice.

Trading and investing in cryptocurrencies and ICO's involves a high level of risk and may lead to the loss of your capital.

Before making any investment decisions, you should consult with a licensed financial advisor.

— Team ADV Capital Academy 🥂