What is Bitcoin and What is Crypto (Cryptocurrency for beginners)

The most common question today when talking about innovations and people who would like to learn something more about trading, investing and the crypto world that was unknown until recently is what is actually Bitcoin?

Read this article and learn different things about BTC (Bitcoin) and Crypto such as:

- How and why it all started

- What is the role of the banks

- Is there a system that doesn’t include banks and governments

- What are actually cryptocurrencies and what is a blockchain?

- Why Bitcoin and Cryptocurrency

- What is blockchain and how does the blockchain work

- Are Blockchain and Cryptocurrency revolutionary?

- What are altcoins?

- How to make money with Bitcoin and Crypto

- Bonus: Free Cryptocurrency e-book

- Bonus: Free Cryptocurrency course

Or watch the video by clicking on the picture bellow:

The story starts thousands of years ago...

Since the beginning of the human race, people were exchanging goods and things needed for regular life. At the start, they used bartering one object for another. One guy had fruits, another had eggs. For example, they would go to the market and exchange four eggs for a pound of apples. The problem came when people had bigger things, like cows and chickens. How can you buy a cow if you only have two chickens? A third entity was needed, so they used the scarcest of seashells.

Then came coins made of precious metals. In the beginning, coins did not have a value stamped on them, rather the coins were weighed. Only later was an actual value stamped onto the coin. Instead of bringing coins anytime, people go somewhere (you can imagine people carrying 20 pounds of gold with them in the bag when going out), some people made an institution where you can bring your golden coins and get a receipt for that. Instead of going out with all the coins, people were going to the markets with the receipt and it made it easier to buy the goods needed. The idea was that you could literally walk into a bank and ask for the equivalent of your banknotes in gold. That is how the banks and paper money started.

Paper money was backed by precious metals e.g. gold. In 1913, Congress created the Federal Reserve to stabilize gold and currency values in the U.S. When World War I broke out, the U.S. and European countries suspended the gold standard so they could print enough money to pay for their military involvement. Later on, the paper was taken off the Gold Standard and was not backed by anything, allowing the printing of money to flourish. This is the current ‘fiat’ money that we use.

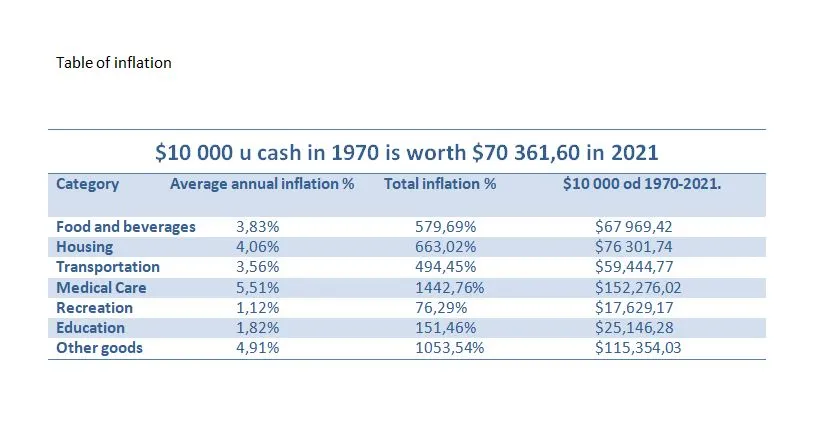

US government can print an unlimited amount of dollars whenever they get in trouble, but that triggers other problems. One of the problems is inflation. More money printed, fewer values the money has. What would happen if you decide to save money? If you take a look at the next chart, you could see that what you could buy with 10 000 dollars 50 years ago, now you would need more than 70 000 dollars.

Can we trust the banks?

Even when paper money was backed up by Gold, just think about who could guarantee you that bankers were not able to print more money than they had in reserves? But what would happen if all the people came to ask for their gold reserves?

One of the reasons for market crashes during the years are governments and central banks. We had some big market crashes such as Black Tuesday (1929), Black Monday (1987), and the Tech bubble (the 90s) …

While all these years were horrendous, the 2008 crash was the worst of all. Not only that it did shake financial markets, it also destroyed global companies, it left people broke, homeless and resulted in a loss of a lot of human lives.

If you watched the movie “Big short”, then you know what we are talking about. It was very easy to take on debt and credits. Banks were giving credit to people who had no coverage at all. Everyone was confident that they could eventually pay it back.

That is not the first time that banks and governments didn’t fulfill people’s trust. People were sick and tired and something needed to be changed. Bitcoin was starting to thrive.

A system that doesn’t include banks and governments

Most payment systems today run on a centralized network. The problem with this is that you have to incur unnecessary and expensive transaction fees. Usually, this is done by a central server that keeps track of your balances i.e. your credit card and/or the banks. If you want to send money to your cousin that lives on another continent, it can also take several days for one bank to talk to another bank and sending money becomes both expensive and takes too long.

A programmer calling himself Satoshi Nakamoto (could be a group of people as Satoshi Nakamoto is just an alias) created a technology that took care of this huge issue. He successfully found a way to build a decentralized digital cash system, thus avoiding the need for a centralized system. He describes it in a surprisingly simple way in his White Paper. A decentralized system means the network is powered by its users without having any third party, central authority or middleman controlling it. Neither central banks nor governments have power over this system.

A few years ago, we wanted to send some money over to Australia. In order to do that, we had to pick up the phone and call our bank. We were listening to music for over nine minutes just to start the process. We were then charged for sending the money plus an extortionate Foreign Exchange rate that did not resemble the real rate. Finally, since the transaction was via something called an intermediary bank, we were told that they would likely charge us as well, although they could not tell us how much. The money, we were told, would be there within 3-5 working days. Since it was a large amount of money the whole thing cost us over $250 and if you include the Foreign Exchange spread, maybe more. We agreed to everything because, well, we didn’t have many alternatives.

With cryptos, we can send Bitcoins and other cryptocurrencies directly to other people from a phone or computer, within one minute. There is no spread, no Foreign Exchange (Forex) charge, intermediaries, etc. And the whole thing might cost us $1 maximum.

So if you want to save a lot of time and money then cryptos are the right thing to go. You are in control of your own money using cryptocurrency. This is what we call the ‘decentralized’ system. It is possible to be able to pay and receive money anywhere in the world at any given time. Your transactions are practically immune to any influence from your government, with minimum processing fees, thus preventing users from having to pay extra charges from banks or any financial institutions.

What are actually cryptocurrencies and what is a blockchain?

Cryptocurrency is a digital currency - a combination of two terms cryptography and currency, which can be used to digitally transfer money to another person safely, without having to use intermediaries or trusted third parties. So, this is a currency that is protected through cryptography. Cryptography is an old way of hiding specific information from unauthorized parties by converting the information into illegible numbers, letters, and symbols.

The most important thing about it is that no central body maintains its records and controls its liquidity. Every person who uses the internet has access to the records of all the transactions of that particular cryptocurrency. That’s where the idea of blockchain comes in.

Why cryptocurrencies?

There are two ways which secure that safety is provided with digital currencies. The first is that it uses the encryption technology that we already mentioned.

The second way is to have a public ledger, where all the transactions are kept. Thousands of computers around the world are linked together to display this ledger. They refresh and update every minute. This network of computers all linked together in this way is called the blockchain. You can trust it because it means that each transaction has been verified again and again by all the computers (the blockchain). With thousands of computers linked up all over the world saying the same thing, the ledger’s integrity is upheld. Each cryptocurrency can have its own blockchain, although some are shared.

Blockchain

How does the blockchain work?

Let’s say that you want to send 100 dollars to someone. Somehow someone has to keep track of these transactions, to avoid forgeries or anyone claiming they haven’t received the money. In the past, Central Banks or banks have kept details of the transaction on something called a ledger. This is based on a centralized system.

With Bitcoin, currently the main digital currency, the whole system was turned on its head. Instead of a centralized system controlling the ledger, now thousands of computers, all around the world, each keep a copy of this Ledger.

Every single transaction is kept there, from the beginning to the present day. This is a decentralized system, called the ‘blockchain’. That's the whole point of the decentralized system – the computers allow it to remain decentralized and in the hands of many as opposed to the hands of a few who are trying to control the many.

What is mining?

There are two ways of getting Bitcoin. You can either buy one at the current price (on an exchange or from a person directly) or you can ‘mine’ it. The analogy is like when you mine for Gold. However, with digital currencies, it is slightly different, as you don’t have to go down a mine to do so. With cryptocurrencies, you have to do it through something called, ‘Proof of Work’. Proof of Work refers to the fact that if you want a Bitcoin, you have to prove that you have done work and in return, you get paid in Bitcoin tokens.

In cryptocurrencies, this is done by creating a scenario where if you want to get paid in Bitcoins or Etherium, or some other currency, you have to commit your computers to solve problems or mathematical functions – to help transactions. If the computer solves the problem then it proves that you have dedicated power, time, effort, heat and computation to solve the problem. The more you do this the more of a ‘vote’ you are allowed to have. This vote is embodied in a Bitcoin, Ethereum or any other crypto that you decide to mine. You receive a token of cryptocurrency (a fraction of a coin) in return for mining it.

Only miners are able to confirm a transaction. This is their role in the cryptocurrency network. They record transactions, verify them and disperse the transactional information in the network. What this does is introduce scarcity into the system. Scarcity is important because one way of anything to have value is scarcity. If gold was to be found everywhere, it wouldn’t have any value.

Altcoins

Altcoins are all the other cryptocurrencies than Bitcoin with the goal to solve the disadvantages of Bitcoin. As you could read, Bitcoin has a lot of good sides, but there is still a lot of space for improvements when it comes to speed, energy efficiency, volatility and other stuff.

Their name comes from the fact that they're alternatives to Bitcoin and traditional fiat money. Also, the term “crypto”, short for cryptocurrency, is used for all coins.

Some of the famous altcoins are Ethereum (ETH), Solana (SOL), Cardano (ADA), Litecoin (LTC), Polygon (MATIC), Polkadot (DOT)… And every single one of them has a different purpose and solves different problems.

For example, the Ethereum blockchain focuses on running the programming code or network. Instead of having to build an entirely original blockchain for each new application, Ethereum enables the development of thousands of different applications in a single platform. In the Ethereum blockchain, miners work to earn Ether. Ethereum solves the problems of legal contracts online, eliminating middlemen taking fees from transactions.

Litecoin was meant to be the “silver” to Bitcoin’s “gold”. The main difference between Litecoin and Bitcoin is the 2.5 minute time to generate a block for Litecoin, as opposed to Bitcoin’s 10 minutes. One of the biggest advantages that Litecoin possesses is that it can handle a higher volume of transactions thanks to its algorithm. The faster block time also prevents double-spending attacks.

Today, there are thousands of different, great, undervalued companies that have the potential to 100x their worth in the next few years which we talk about in detail in our Crypto Masterclass™

Are Blockchain and Cryptocurrency revolutionary?

The market experts have named blockchain as the new internet because once implemented fully; it could change the way the internet works. What makes cryptocurrencies and blockchain so good is the fact that their scope is more significant than people realize today. They are not just currencies or ledgers, but future internet technologies will be based on the blockchain. With digital currencies, we can create a world where no fiat money will exist, and no factors from the outside world (the real world) will affect the value of cryptocurrencies. The more notable thing is that those investing today are the most potential millionaires of tomorrow.

Things have changed big time in just a couple of years. Some of the

world’s biggest online retail stores, gift shops, and small stores are now accepting cryptocurrencies. In fact, some online shops only accept cryptocurrencies. Elon Musk and Jeff Bezos – the two richest men talk about coins almost every day and consider different coins for their businesses. More and more blockchain-based platforms are coming into existence every month.

Long story short: a lot of things are going on…

How to make money with Crypto and Bitcoin

There are more than 9 ways to make money with cryptocurrencies. But, here are the most well-known ways. You can:

1. Buy them - with anticipation for the price to move up. (Buy for the cheaper price and sell when the price is higher)

2. Short them - selling with anticipation for the price to move down (in case that price is too high and cryptocurrencies are in a downtrend)

3. Lend them – traders who need margin and leverage, borrow your coins to trade with. They have to give them back to you with a % commission.

4. Mine them – use the computational power of your computer(s) to help verify certain transactions on the blockchain and be rewarded with Bitcoin or other coins.

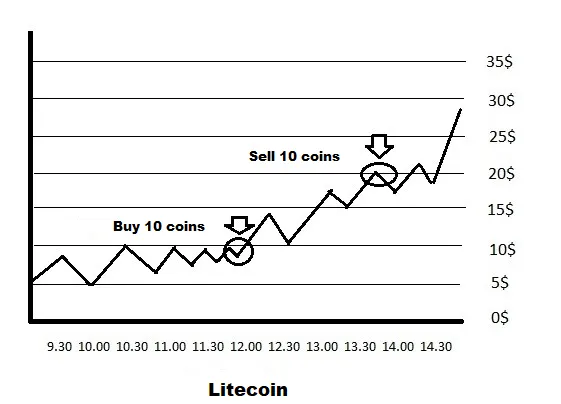

Let’s say that you buy a crypto (for example Litecoin) when the price is at 10$ per coin. It means you opened your position. And you sell it later at 20$ per coin to close a position. You made profits. You bought one coin for 10$ and sold it for 20$. The difference is 20-10=10$. You just made 10$. In case you bought one coin, that will be your profit.

For example: If you bought 10 Litecoins at 10 dollars, and you sell them one day later when the price is 20 dollars, you will spend: 10 coins x 10 dollars = 100 dollars to buy. The price when you sell is 10 coins x 20 dollars (now the coin price went up) = 200 dollars. So u made 200-100=100 dollars.

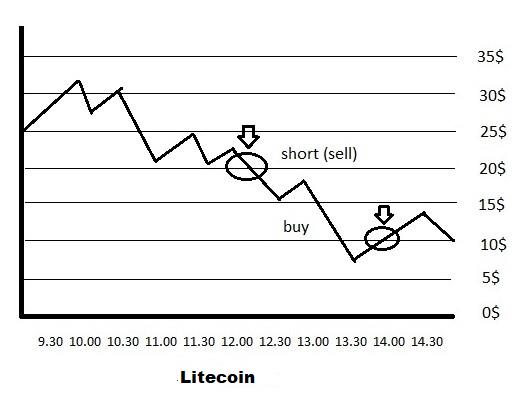

Most people think that buying and selling is the only way to make money with coins, and that is not true. The beauty of trading and one of the differences with investing is that in trading you can also make money when the price goes down.

The second way to make money is by shorting (short selling) a coin at a higher price and buying it back at a lower price. Let’s say you short it (sell) at 20$ to open a position because the company is overvalued and technical analysis shows that price is going to go down, and you buy it back at 10 to close a position. So with the same math, you made 10$ in case you shorted just one coin, or 100$ if you shorted 10 coins.

Now, you may wonder how you can sell (short) a coin that you don’t own. Well, It means that when you click sell (short sell), the broker is lending you coins that you need to bring back. So basically you borrow coins from your broker at 20$ and then you need to return it back. But your goal is to buy it back for a cheaper price, so you can make money. When you sell, it is called: selling short, and when you buy back it is called buying back or covering the position.

You may also question why would broker lend you coins? One of the reasons is that it gives liquidity to the market. Another reason is that they charge the fees for landing you. It is a pretty low price for borrowing, but since they have millions of people borrowing, brokers make very good money out of it. The longer you borrow, the bigger is the interest rate. So It’s in our interest to make a profit faster and close a position.

Down point is that another difference between trading and investing is that for trading, there is no good market or bad market if you are a professional. You can profit both ways when you follow the direction of a coin price. And you are the one who could determine the directions of coin prices by studying patterns and trends. You go long when the markets go up and you go short when the markets go down and that is how you make money. In investing, you go long when markets go up, but you can get out of your investment once the markets start going down and buy it back again when markets are recovering...

That is not all, there is a lot more about Crypto basics and Bitcoin for beginners, but it would be too much for just one blog post.

That's why we wrote a free e-book to help you to learn more about cryptocurrency, bitcoin, trading and investing...

Click here to download the book: THE ULTIMATE GUIDE TO BITCOIN AND CRYPTOCURRENCY TRADING AND INVESTING

We also have a free course where you can learn about Crypto Trading. You can find a course on this link: Free Crypto Trading And Crypto Investing Course

If you are serious about learning and you want to take your knowledge to the next level, we have the most complete Cryptocurrency Trading And Investing course - Crypto Masterclass, that you can find on this link.

Thank you for your time,

We wish you all the best in your ventures,

ADV Capital Academy Team